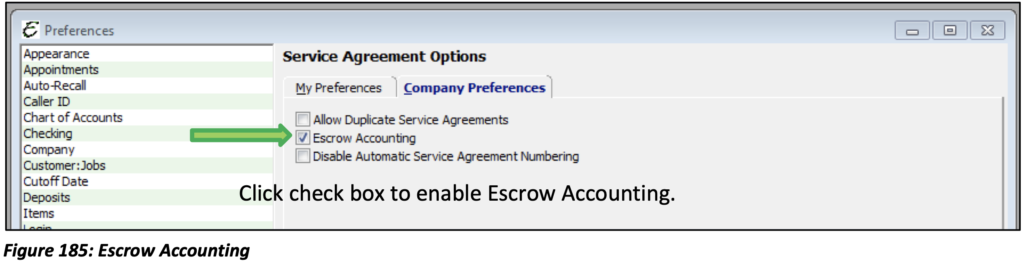

Note: This is an advanced feature that you can turn on at a later time.

Setting aside an asset (like cash) pending the fulfillment of a condition is considered as Escrow Accounting. The asset is only free to use once the condition has been met. For Total Office Manager, escrow accounting sets aside upfront money collected from sales of Service Agreements in an escrow account, pending fulfillment of the actual work promised in the agreement. Once the condition of completing a planned maintenance work order is met, then a certain amount of money held in the escrow account is free to be recognized as income. This process prevents all of the prepaid cash from being recognized as income prematurely.

For example, a two-visit service agreement has been sold to a customer. The prepaid funds received from the customer are not yet truly income because no planned maintenance visits have taken place. If the customer cancelled the agreement before completion of any maintenance visits, you would be liable to the customer for their prepaid money. It is only after each planned maintenance visit is completed, that half of the collected money can truly be recognized as income. Until the condition of performing a maintenance visit has been met, the money is kept in an escrow account.

Overview of the Process

After setting up each service agreement as an invoice item, the day-to-day process of escrow accounting service agreements is not much different than using ordinary service agreements. However, it is extremely important that the proper steps be taken in sequence through completion. The specifics are discussed in detail below, but the basic steps are:

- Sell a service agreement to a customer.

- Create(record) the new service agreement for the customer.

- Create the planned maintenance work orders for the service agreement, before saving and closing the new Service Agreement.

As long as the previous general steps are followed in order and without interruption, escrow accounting service agreements should not be a problem to manage in an “enterprise-level” company.

Overview of the Escrow Accounting Transactions

The behind-the-scenes transactions which occur when using Escrow Accounting are as described below. Understanding these transactions, when they happen, and the concept as a whole is important to properly manage escrow accounting service agreements in the system.

- When a service agreement is sold, the prepaid funds are temporarily recorded as income.

- Special Escrow Movement Journal entries are created automatically once you have created the Planned Maintenance Work Orders.

- One journal entry is created to immediately move all of the prepaid funds from income to the escrow holding account. (Please speak with your accounting professional to determine which account will be designated as the escrow holding account.)

- Other journal entries, one for each planned work order, are then created which move a set amount of prepaid funds back into income on the date of each Planned Maintenance Work Order.

These journal entries are the backbone of service agreements escrow accounting. They are listed and managed through the Escrow Movement List. Under certain circumstances it may be necessary to modify these journal entries. If the Planned Maintenance Work Order date is manually changed after it has been created, the Escrow Movement date will also need to be modified.

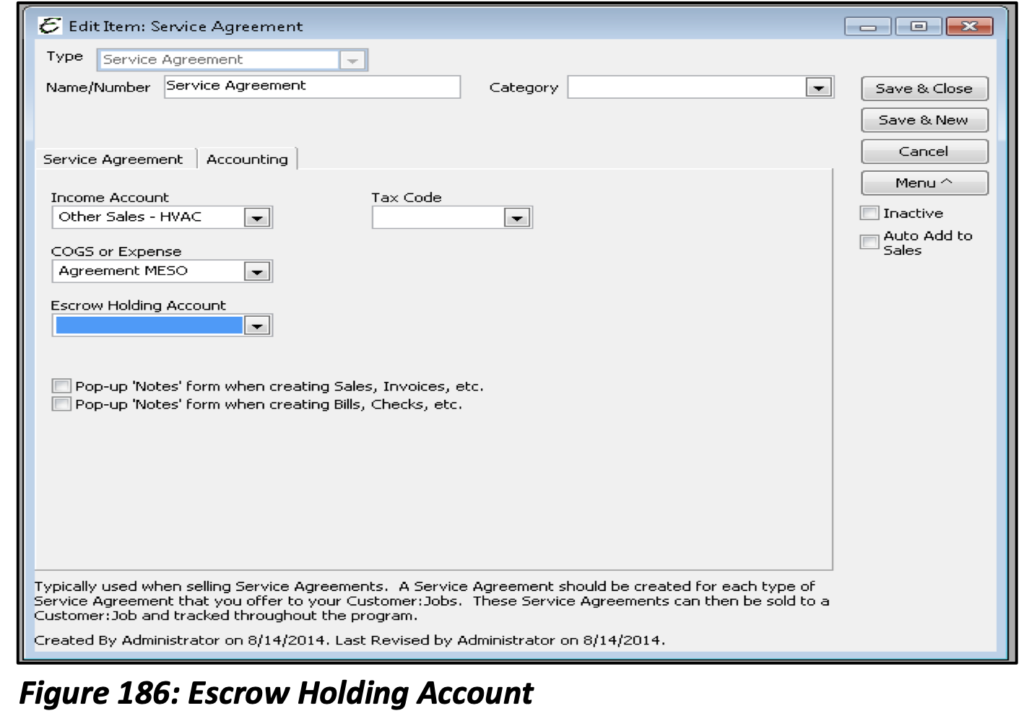

Creating Service Agreement Invoice Items

Creating a Service Agreement using Escrow Accounting is identical to creating any other service agreement invoice item, with one exception. When Escrow Accounting is enabled, an additional field called “Escrow Holding Account” appears on theAccounting tab to the Add Item form. This is where to choose which escrow account to use for holding prepaid money when a service agreement is sold to a customer.

Tip: Please refer to your accounting professional when choosing this account. The Account Type must be an Other Current Asset as Liabilities are tracked to Vendors in Total Office Manager.

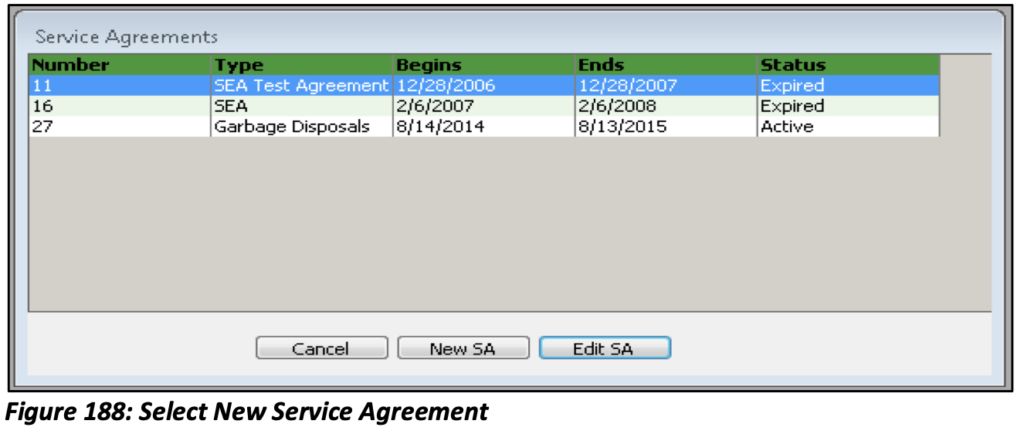

Selling an Escrow Accounting Service Agreement

Once you have sold the service agreement you will again be asked to do the “paperwork”. On this step you must select “New SA” in order for the corresponding escrow journal entries to generate. DO NOT select “Edit SA” this will not generate the needed journal entries. DO NOT select “Cancel”, even if your plan is to come back to this at a later point, as canceling the process causes the needed escrow journal entries not to be generated.

Please note: You must complete all steps from beginning to end, creating a “New SA”.

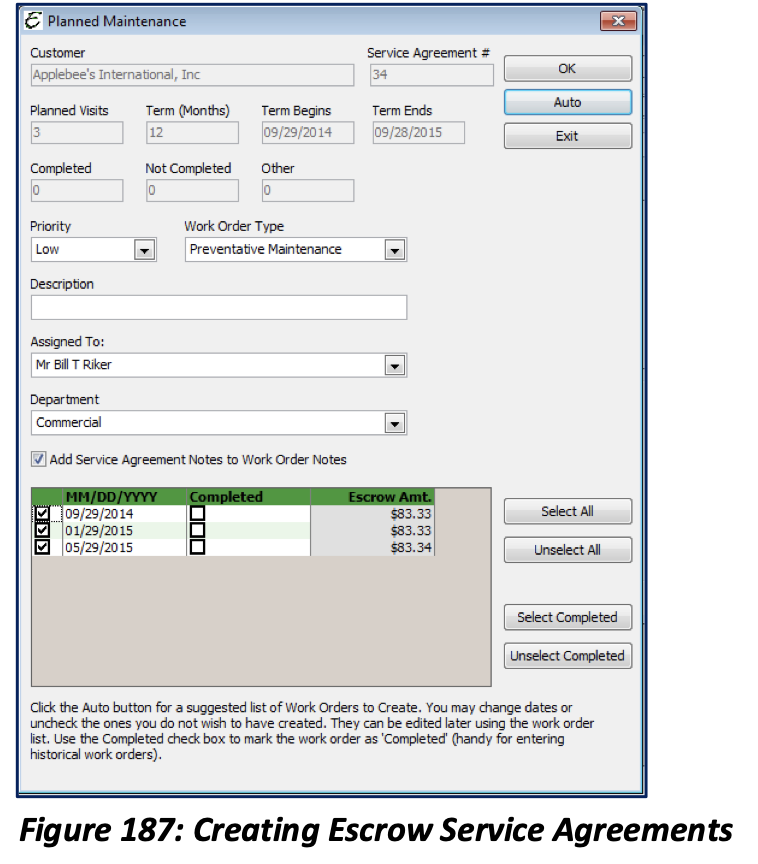

Creating Escrow Service Agreements

This step is nearly identical to creating any other service agreement except there is a slight difference you will notice when generating your planned maintenance work orders.

You’ll notice that each work order is assigned its own dollar amount. The total amount of the service agreement is split equally amongst the number of work orders specified in the service agreement. This is how the escrow accounting method will recognize the income once each work order is completed. The Escrow Accounting for service agreements will also allow the customer to reschedule any work orders or to cancel at any point any future work orders without being charged for work not completed.

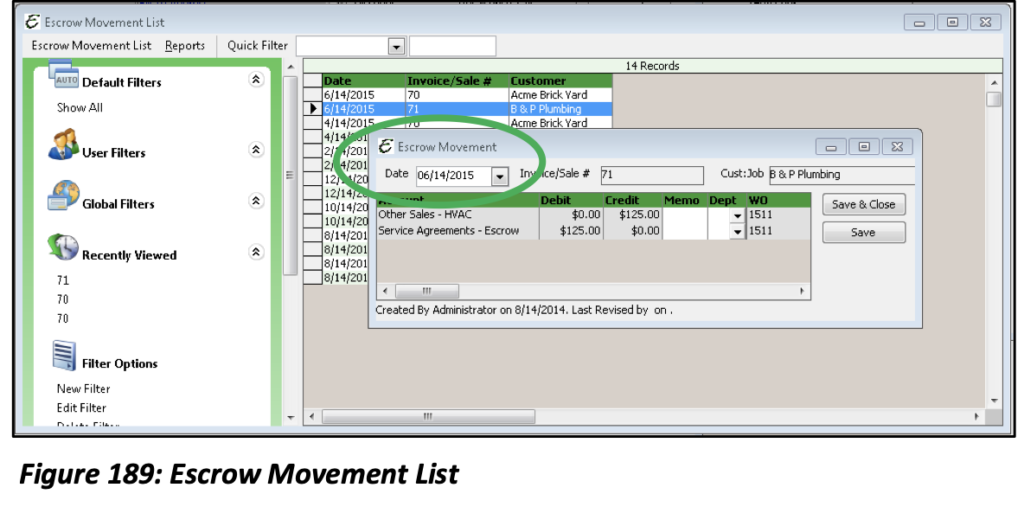

To explore the journal entries made by the escrow transactions, select the Customers menu, then the Escrow Movements List.

The Escrow Movement List

The Escrow Movement List is used to manage the escrow accounting journal entries. These are necessary transactions which were automatically generated when the planned work orders were created. Although the planned work orders and their corresponding escrow movements were created together, once generated they are both completely independent of each other.

Please note: Adjusting a planned work order will not have any effect on its associated escrow movement. Adjusting an escrow movement will not have any effect on its associated planned work order.

Within the Escrow Movement List is every journal entry that was generated to correspond to the work order that was created from the Planned Maintenance in the Service Agreement. If a customer chooses to reschedule a particular Work Order, the change must be made on this form. It must also be changed on the work order.

Escrow Accounting Reports

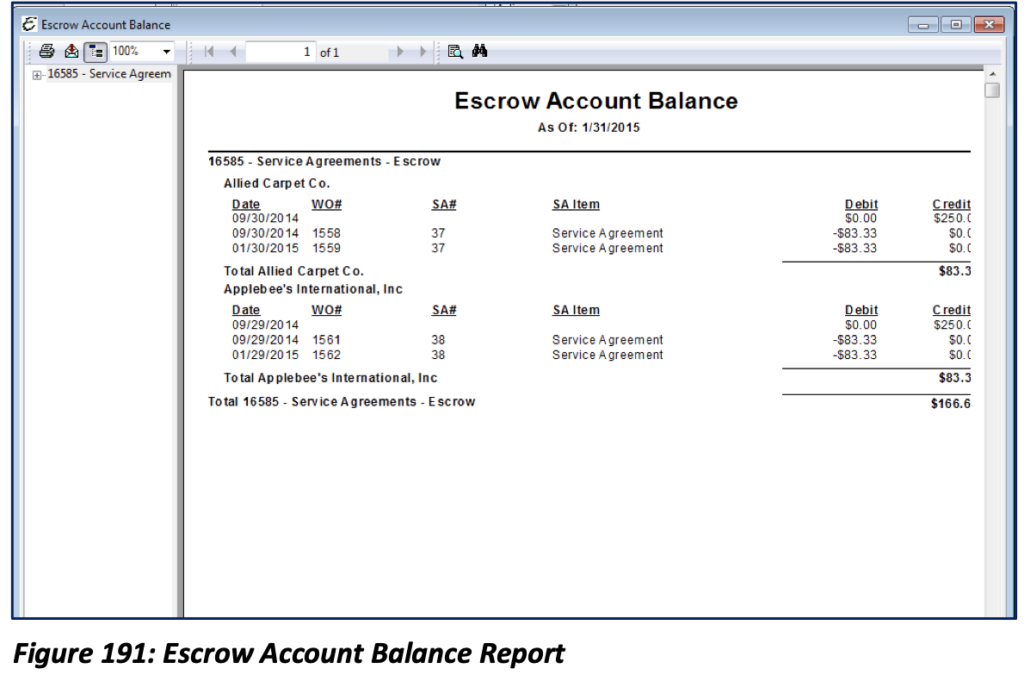

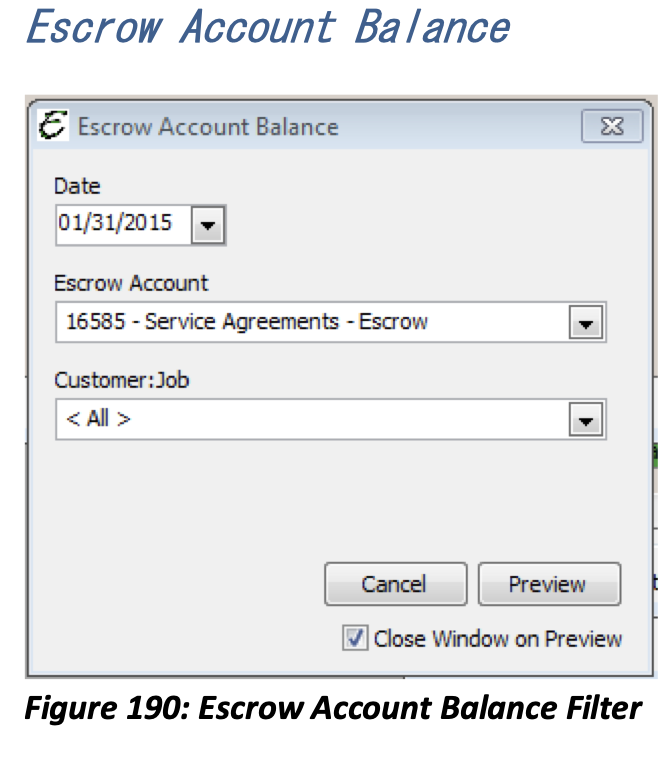

There are two reports for Escrow Accounting: Escrow Account Balance and Customer Escrow Movement. These reports are located under Reports│Sales│Escrow Movement.

The Escrow Account Balance Report provides a snapshot of how the Planned Maintenance Work Orders are applied against the original invoice amount.

There are three selections for the filter criteria:

Date: This is the date you would like the report to run through.

Escrow Account: If you have more than one Escrow Account, you may want to run a report for all of them or just a specific one.

Customer Job: You may choose a specific Customer:Job or run a report for all of them.